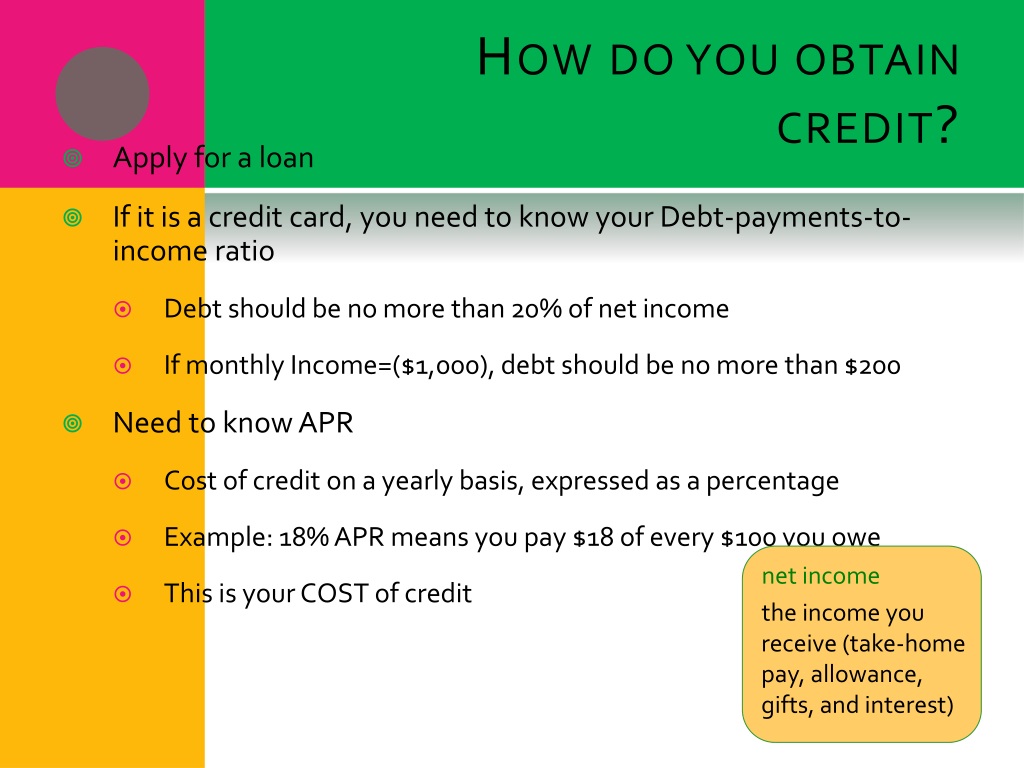

Fun Info About How To Obtain A Credit Card

The best business cards for startups generally combine flexibility with perks and bonuses.

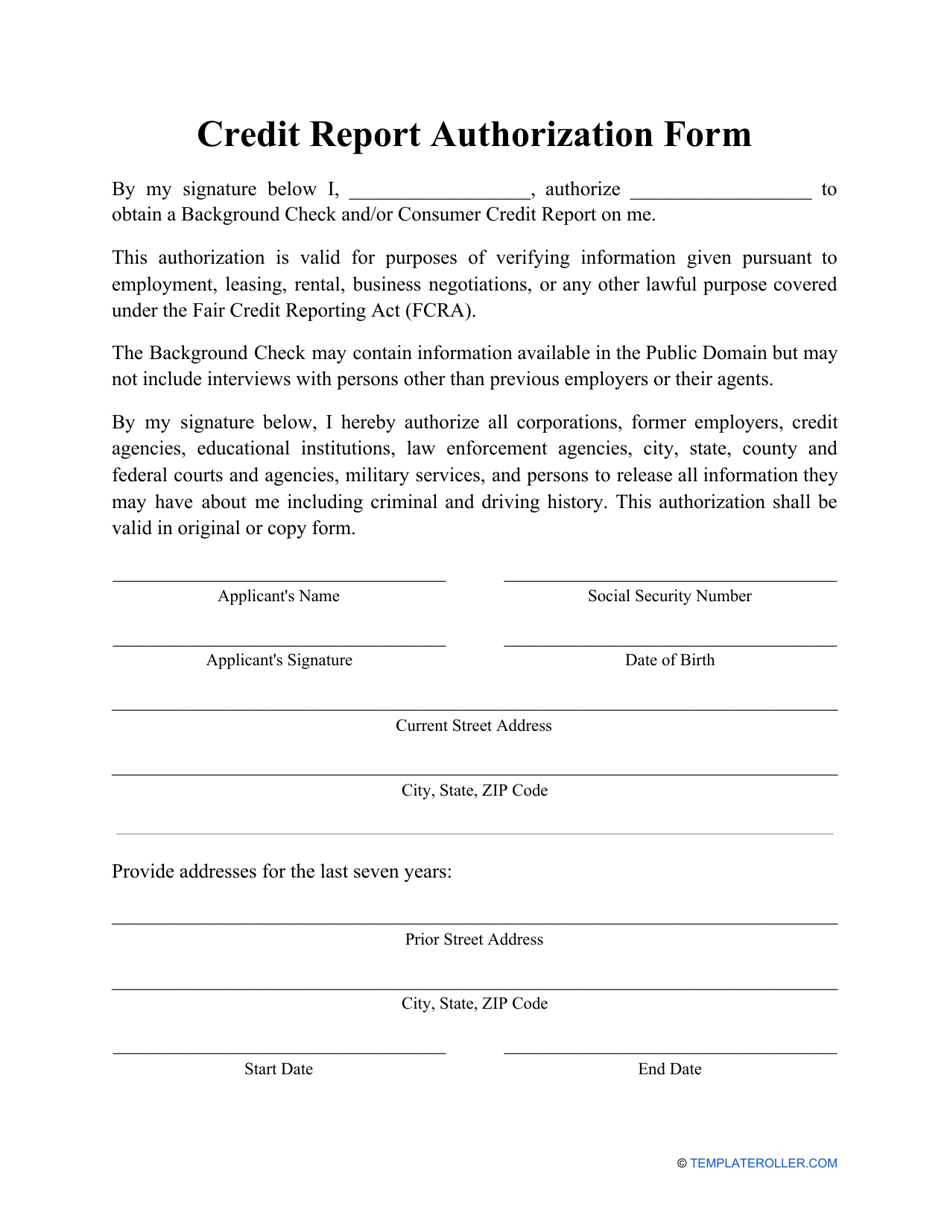

How to obtain a credit card. The most obvious step with most credit cards is a credit check, usually with one of the three major credit bureaus. The cheapest way to accept card payments is to find a processing provider with a fee structure suited to your business model. This will give you a detailed report of your credit history from each of the three major reporting bureaus.

If you process a large number of. Through december 2023you can get a free report once a week. Having a credit card is a powerful way to build credit and credit history.

Get a credit card from your bank or credit union. How to get a credit card. It's a big step, but not a difficult one to.

You can check your report for free once a year at annualcreditreport.com with each of the three major credit bureaus. Small business credit cards for newer businesses. Find the right credit, debit or prepaid card that fit your needs.

Find out the best ways to apply for a credit card, the types of credit cards. Decide why you want a credit card. It is free and easy to check your credit card report for errors — and certainly much faster than having to contact credit agencies one by one after someone steals.

Stolen wallets or lost credit cards. How to accept credit card payments online. After all, the credit card company is extending.

How to get approved for a business credit card. How do hackers get your credit card information? Research and choose a business credit card.

Apply at the right places. The bottom line. How to apply for a credit card for the first time | td bank.

Compare the best credit cards for 2024 and find out. How to accept credit card payments in person. Learn the reasons, benefits and steps to get your first credit card, from building credit to fraud protection.

The changes are a fraction of the fee increases sought by the trump administration. Learn how to get your first credit card before you're ready, and what to do if you're denied. If you have $1,000 in balances and $5,000 in available credit, then your credit utilization is 20%.

/cdn.vox-cdn.com/uploads/chorus_image/image/58250703/Final__DynamicsWalletCard__BankName__Blue__Credit.0.jpg)