Unique Tips About How To Get A High Fico Score

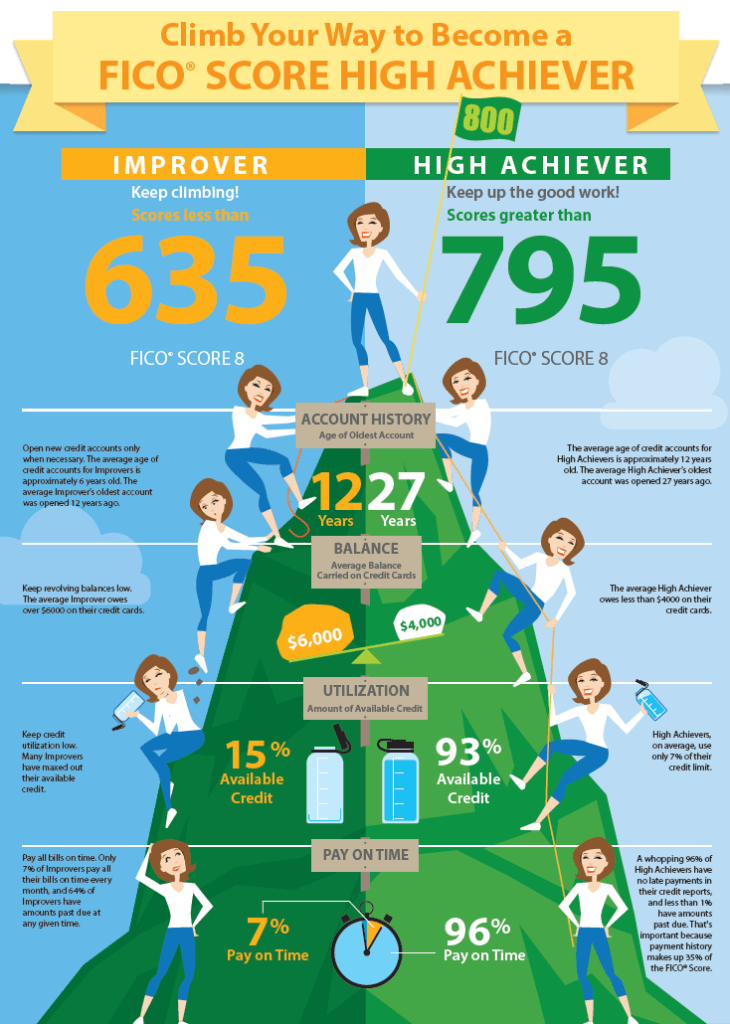

As you might expect, older consumers are more likely to have high scores than.

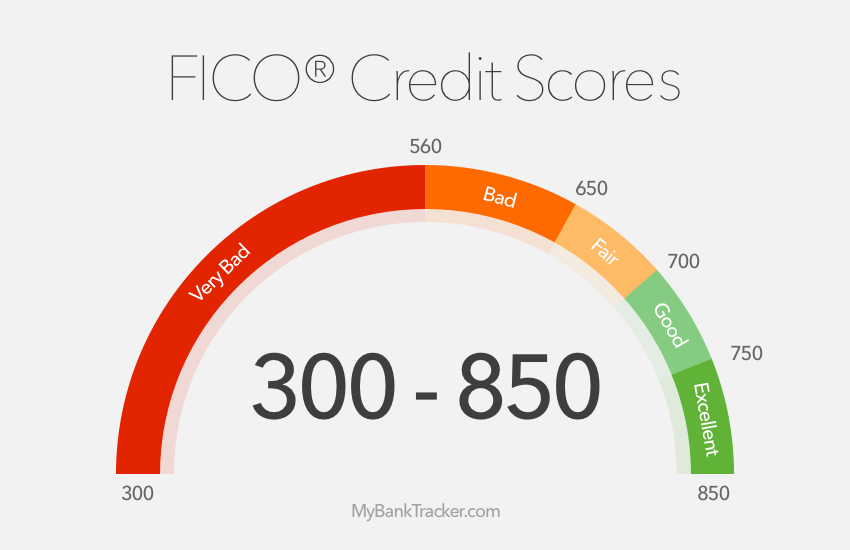

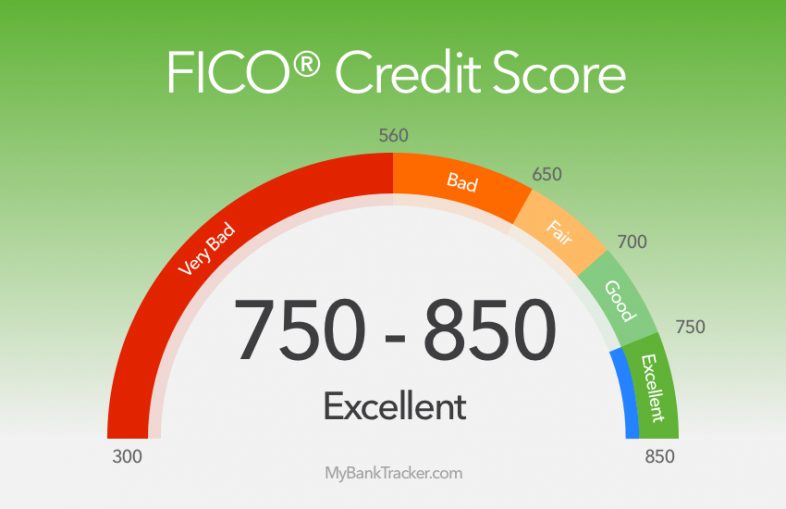

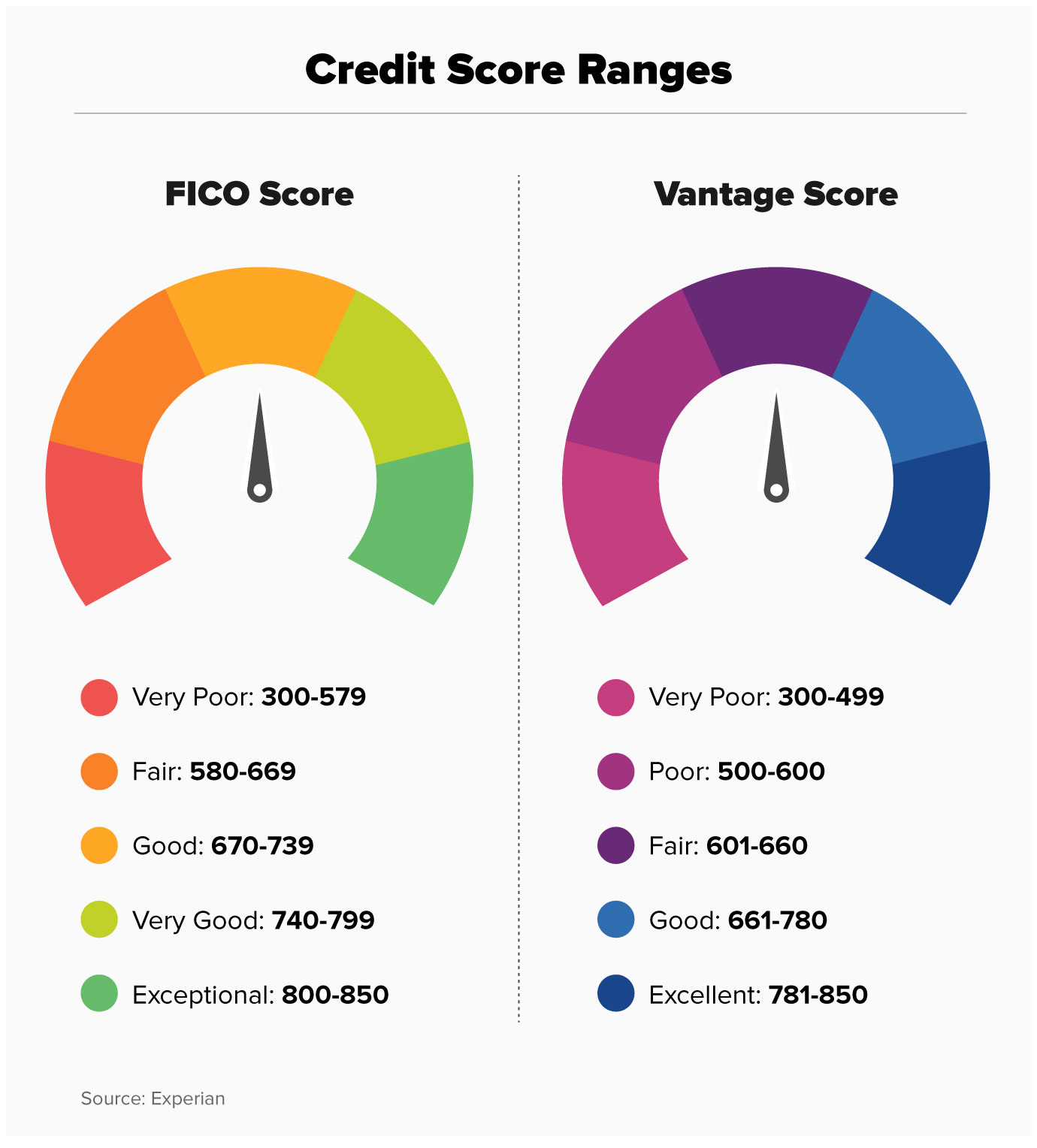

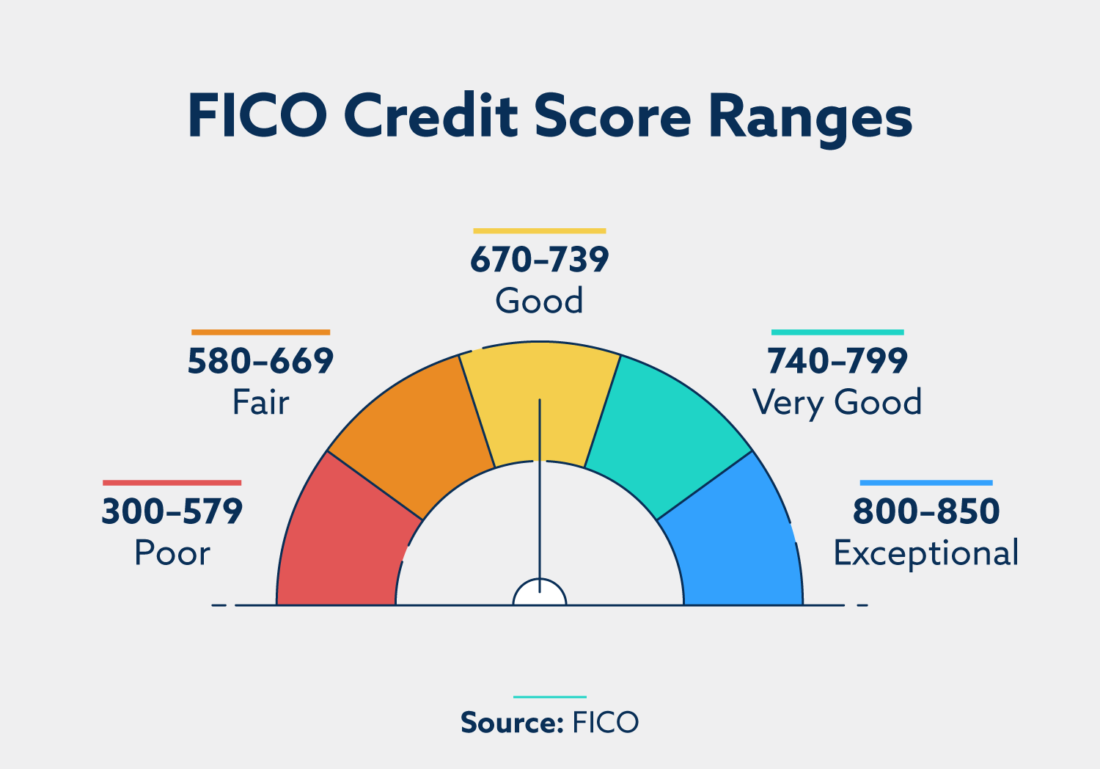

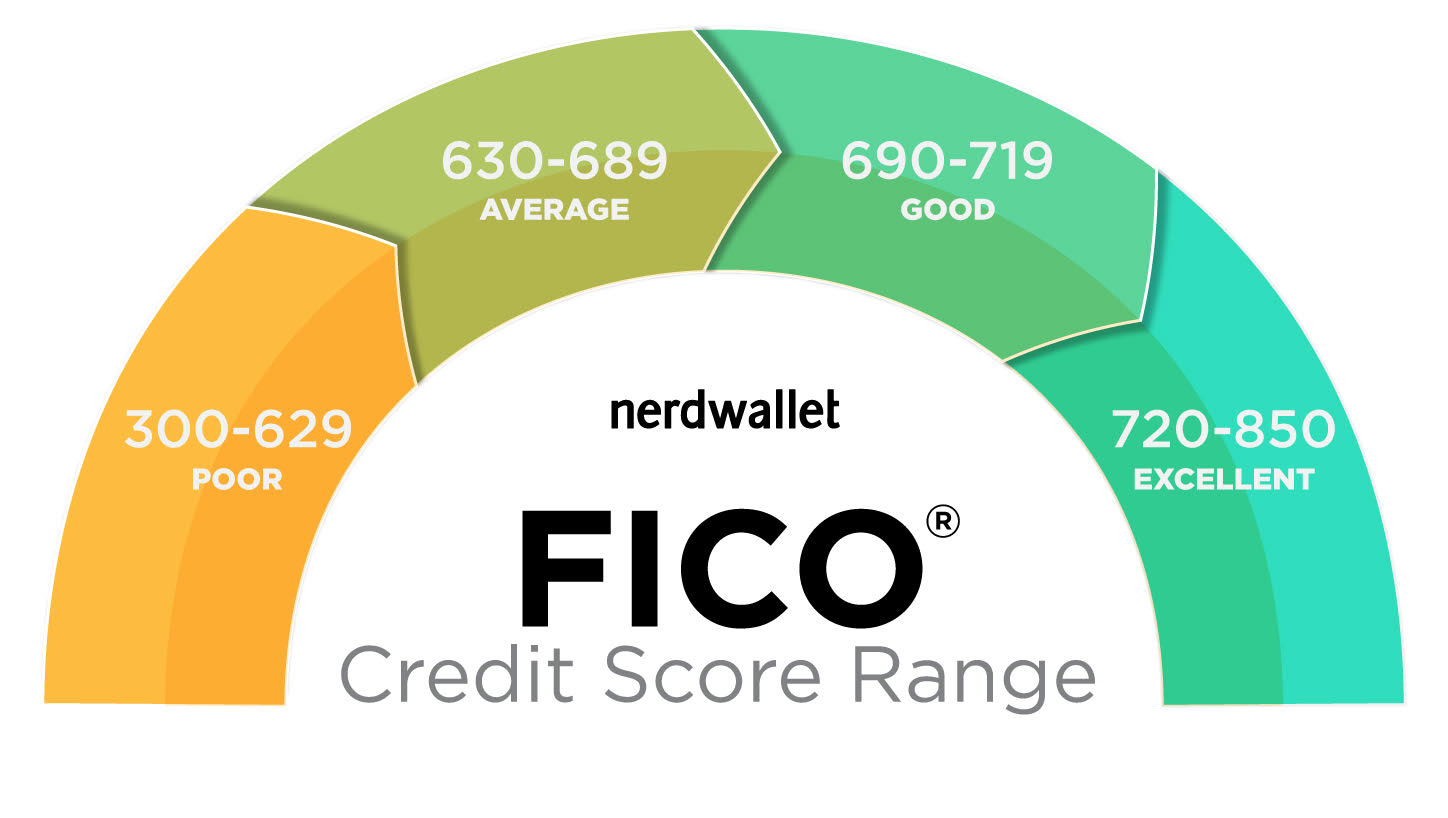

How to get a high fico score. To determine creditworthiness, lenders take a borrower’s fico score into account, but they also consider other details, such as income, how long the borrower has. It all depends on what score you're looking at. The fico scores range from 300 to 850, with higher scores indicating lower credit risk.

The other being the vantagescore. Once you meet the eligibility. How a credit score of 700 stacks up.

This, in turn, affects how. Score dropped significantly after dispute. There’s a premium membership for $24.99 monthly that adds benefits like a credit score.

In order to have access to your free fico score, you’ll typically need to be the primary account holder on a consumer card. Experian, equifax and transunion launched the vantagescore in. What do you think is the highest credit score you can get?

Credit simulation$25 monthly rewardscomplete credit details The way people get excellent scores is by practicing good credit habits consistently and for a long time. Here are the ranges experian defines as poor, fair, good, very good and exceptional.

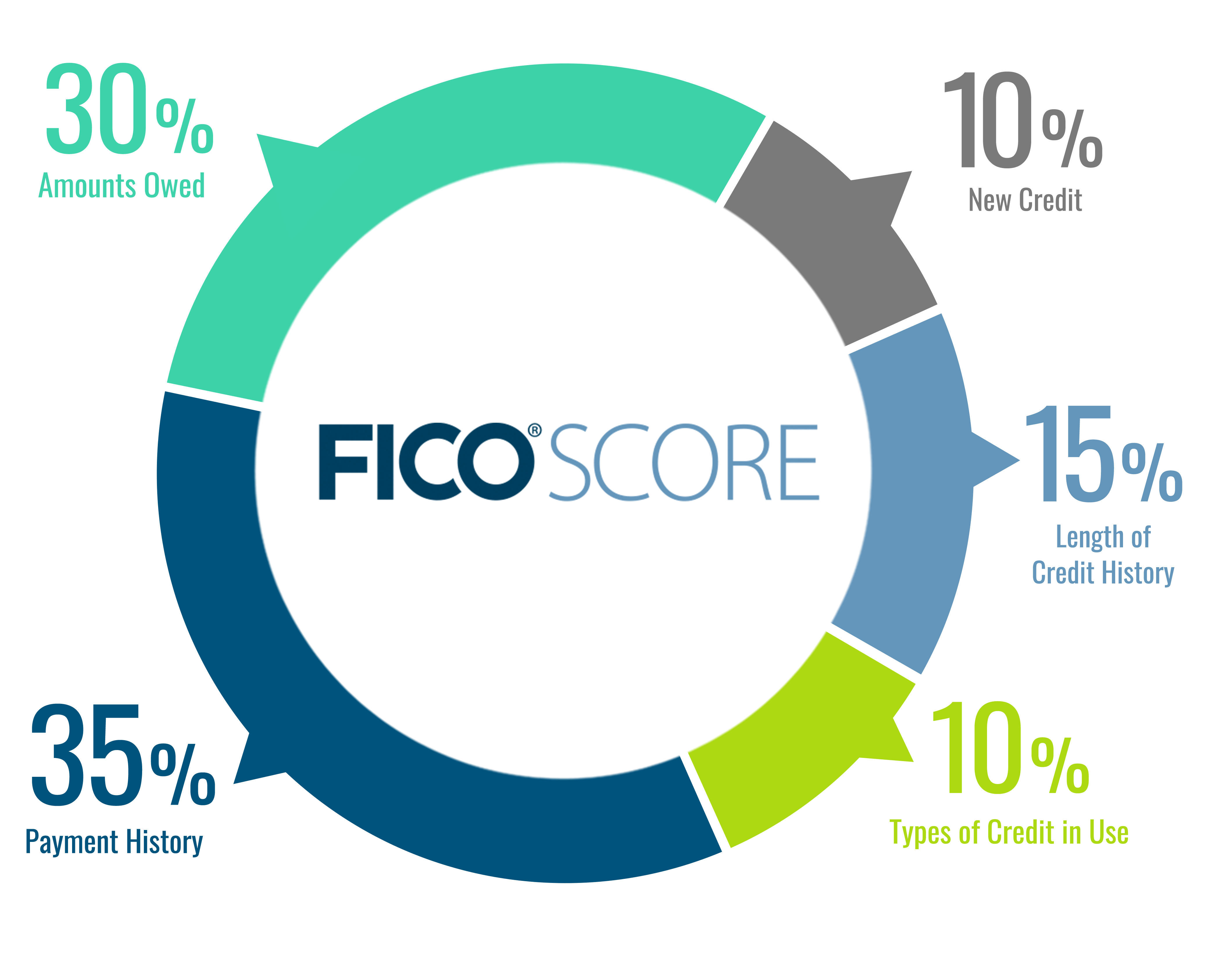

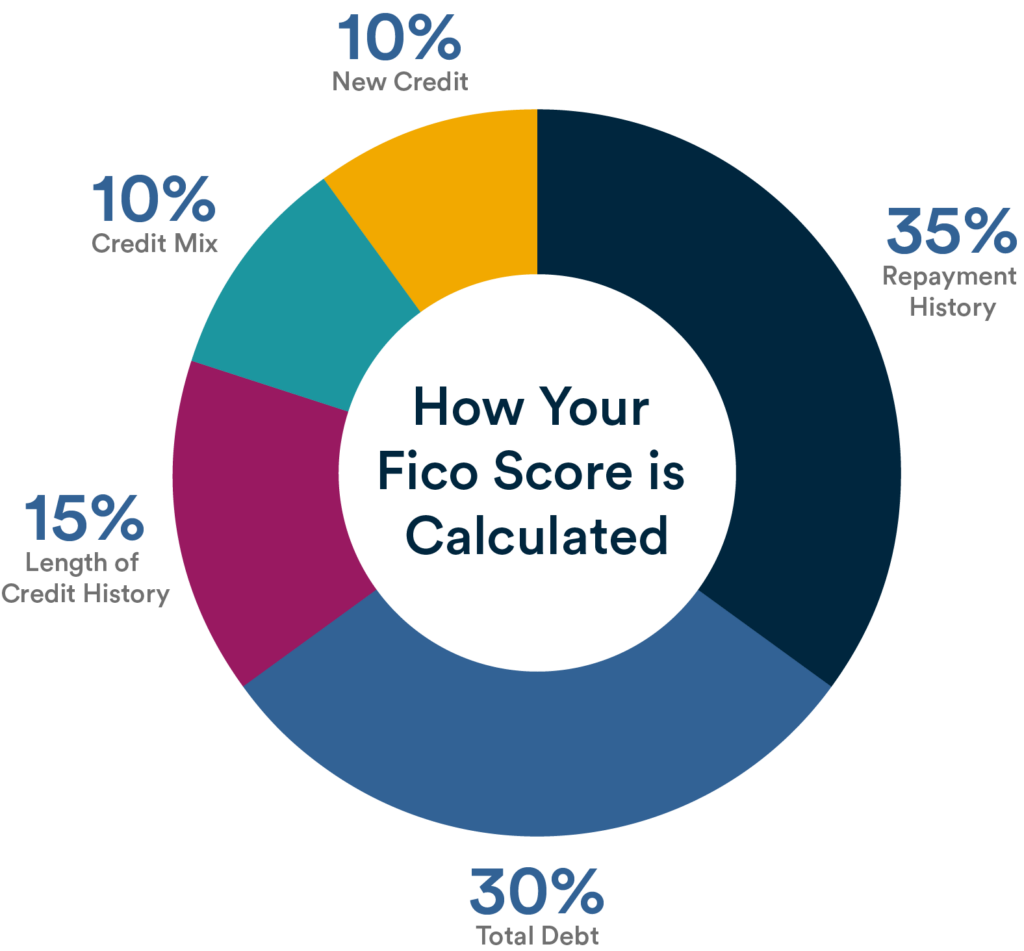

The fico® score is used by lenders to help make accurate, reliable, and fast credit risk decisions across the customer lifecycle. It helps lenders determine how likely you are to repay a loan. Higher scores indicate lower risk, often leading to favorable loan terms and interest rates.

The fico score is one of two main credit scores in the us; Click here to see the highest fico score! The fair isaac corporation (now called fico), which developed the fico.

A fico score provides lenders with an indication of your ability to pay back debt. Pay off debt rather than moving it around: One of the best ways to access your fico® credit score for free is through discover credit scorecard.

If you have a total credit balance of $500 and the max limit on all your credit cards is $5,000, your. Fact checked by katrina munichiello fico is the most recognizable name in credit scores. This range is used by the most commonly known credit scoring models, such as fico and.

Credit scores typically range from 300 to 850. Better mortgage expands offerings to include va loans in all 50 states. The fico score plays a vital role in risk assessment.

/https://blogs-images.forbes.com/robertberger/files/2015/11/Screen-Shot-2015-11-12-at-3.55.34-PM-1200x604.png)