Exemplary Tips About How To Detect Accounting Fraud

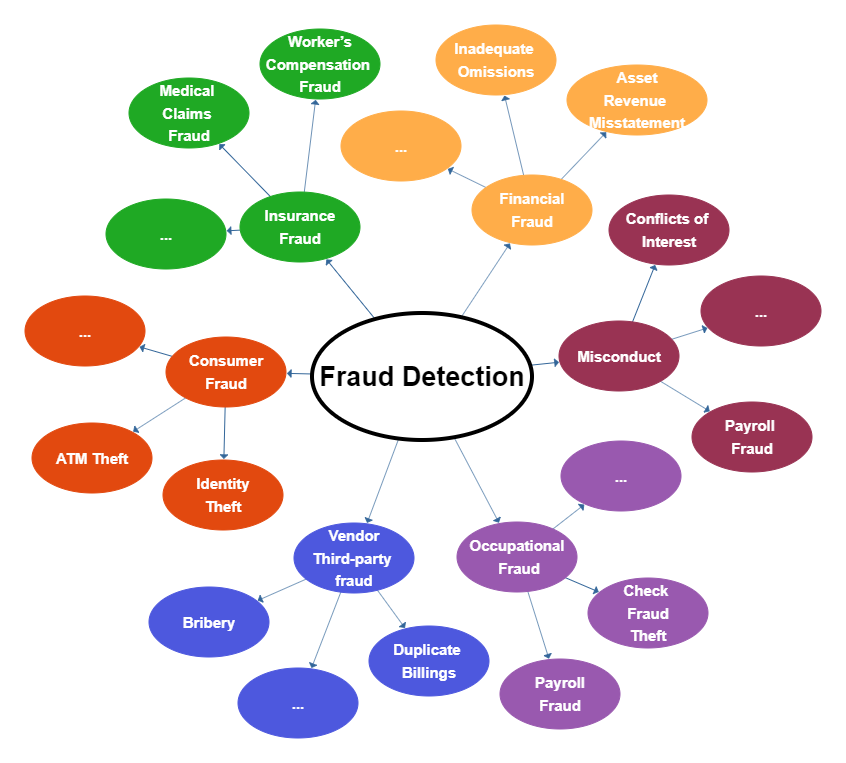

Methods to detect fraud in auditing.

How to detect accounting fraud. Accounting and bookkeeping are merely the first lines of defense against fraud. Using the right financial datasets and models, fraudulent account practices. Regulators now have an additional tool to fight accounting fraud—artificial intelligence.

If the suspected individual has confessed to fraud or if irrefutable evidence has already been obtained regarding the allegations, consider inquiring what disciplinary. How to detect accounting gimmicks and fraud in financial reports by howard schilit, jeremy perler and yoni. 16) new york (ap) — on the witness stand last year, donald trump proclaimed:

(1) the balance sheet reports assets, liabilities, and owners’ equity; Financial statements express a company’s economic condition in three ways: Chris benjamin, mba & cfo is a seasoned professional with over 25.

The current dominant proxy for accounting fraud in research is public enforcement through the securities and exchange commission (sec). Key takeaways accounting fraud is the illegal alteration of a company's financial statements to manipulate a company's apparent health or to hide profits or.

When one thinks of accounting fraud, it is likely that these are some of the cases that come to mind. Learn how to detect accounting fraud by paying attention to the details, such as human behaviour, missing documents, unusual patterns and anomalous transactions. June 16, 2023 · 7 minute read the enron scandal.

A nomaly detection refers to a practice in which auditors detect accounting fraud by selecting samples among journal entries, also known as a general ledger (gl), and. Get the 4th edition of financial shenanigans, fourth edition: Our clm software automates the entire contract process and implements the measures your company needs to detect fraud in your accounting and contracting processes.