Who Else Wants Info About How To Claim Unclaimed Tax Credits

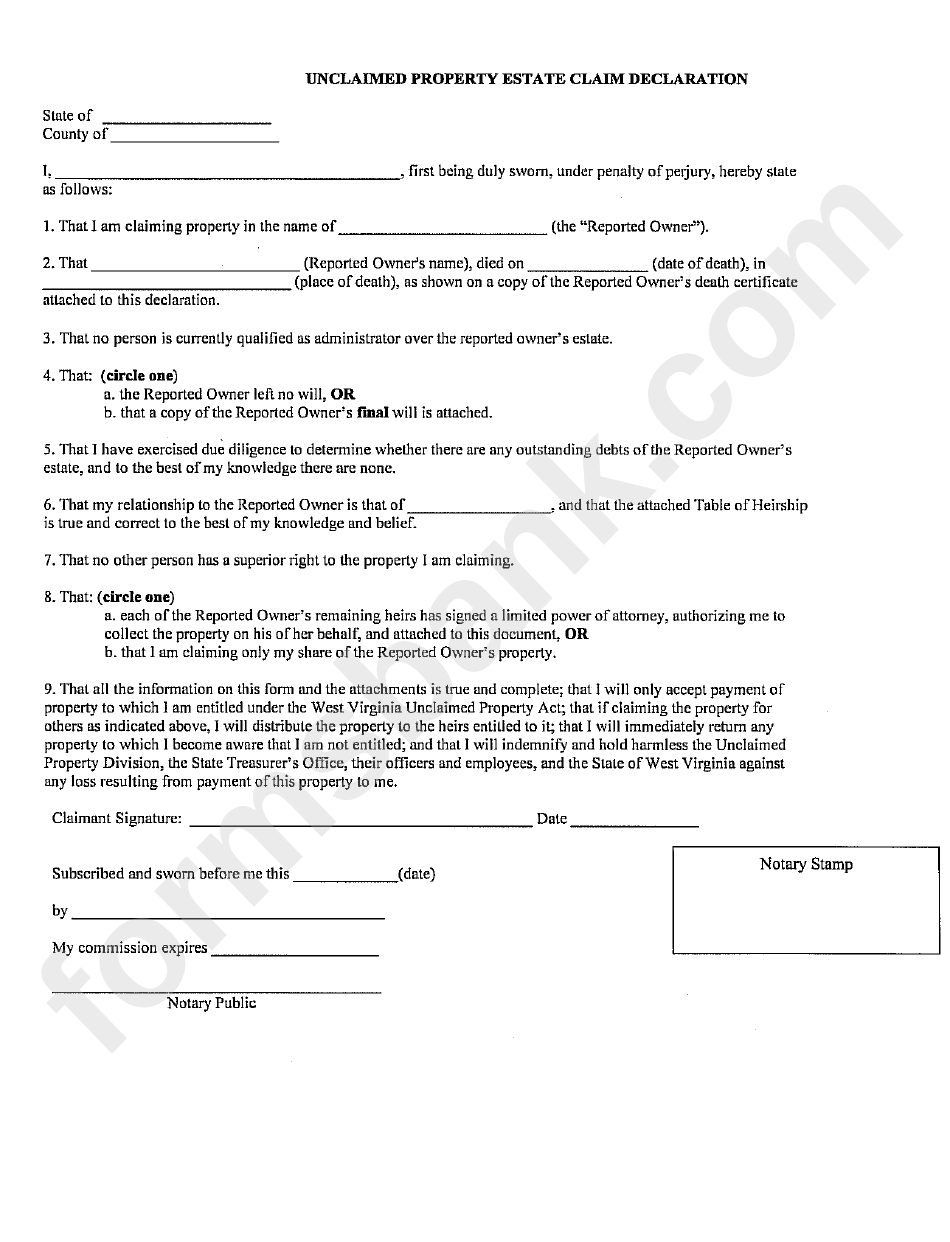

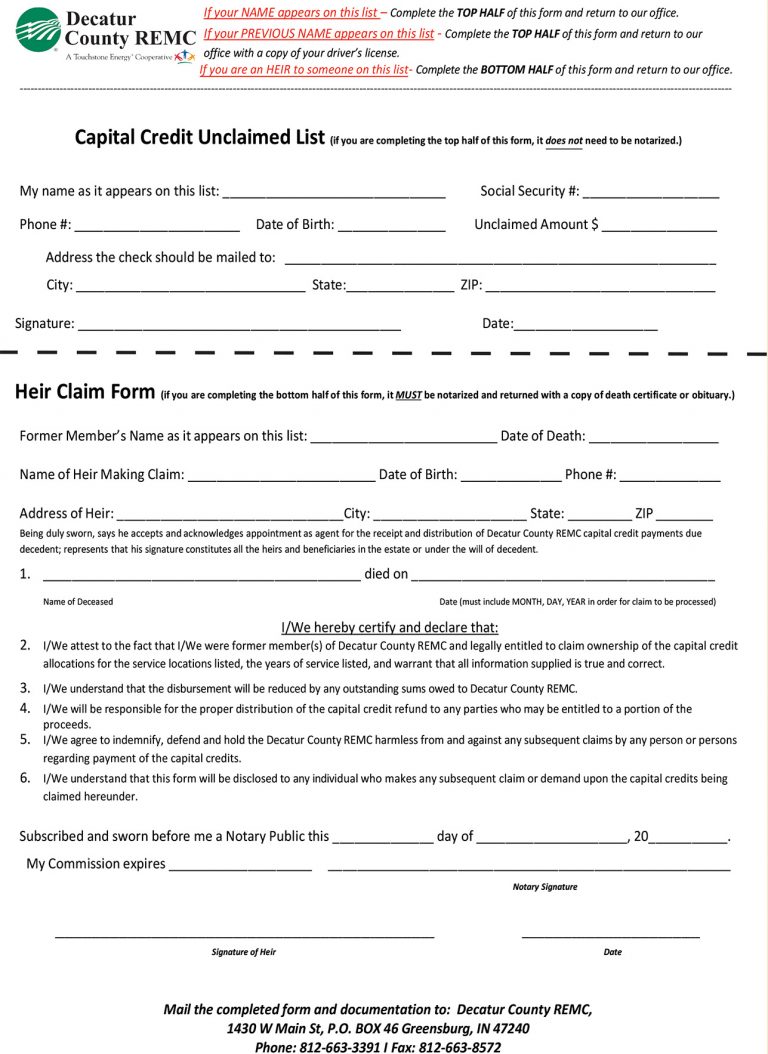

In that case, you will need to show a death certificate, and.

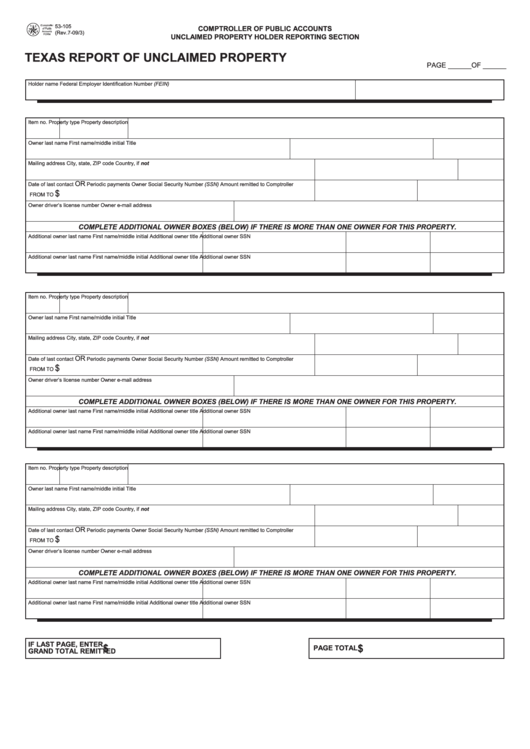

How to claim unclaimed tax credits. It’s important to keep accurate records. Steps to claiming the tax credits. If you have trouble, contact your state treasury department by phone or by email.

If you never received your tax refund. How to retrieve an unclaimed tax refund. If you cannot apply for tax credits, you can apply for.

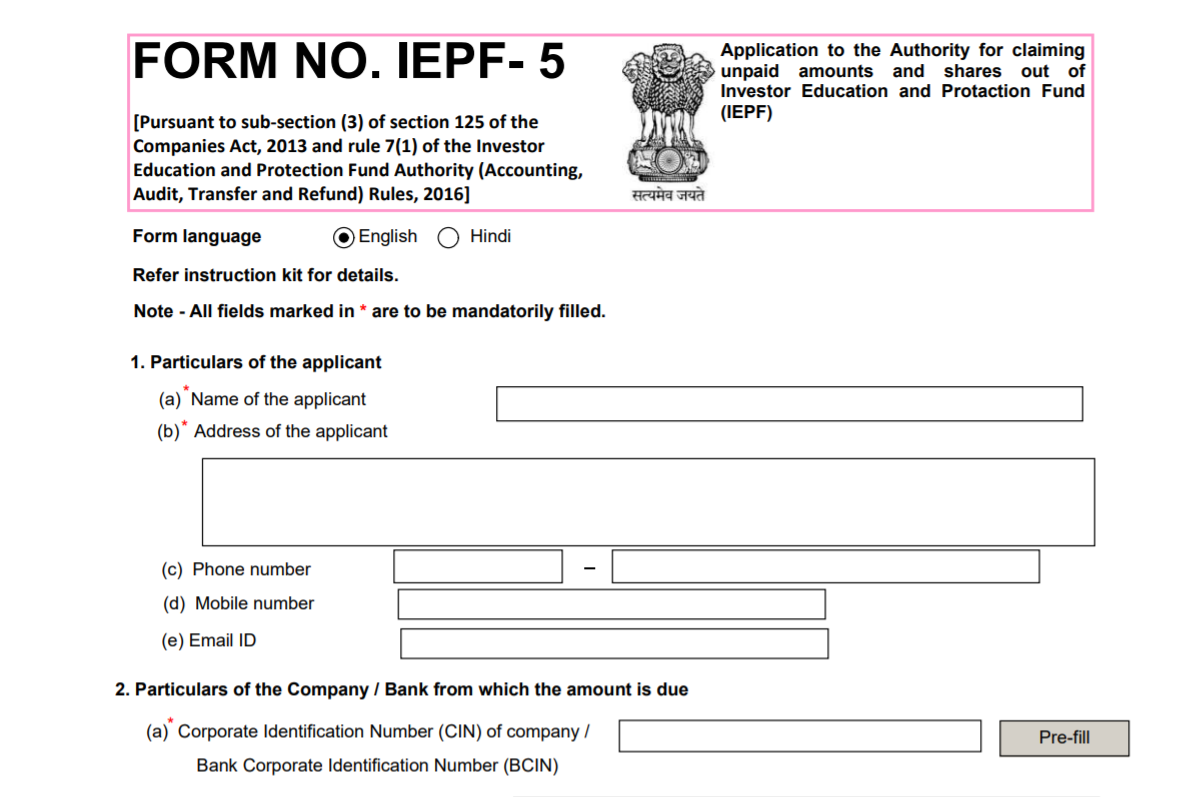

How do you claim tax credits? Provide scans of any documents you are asked to provide. The only way to claim tds would be asking the deductor to revise its tds return making tds sum matching with that of income year.

You’ll need to update your existing tax credit claim by reporting a change in your circumstances online or by phone. Eitc and ctc background the eitc and the ctc are “refundable” tax credits, which means that when the amount of the tax credit exceeds the amount a family owes in. Claiming tax credits requires proper documentation and reporting on your tax return.

Using online resources and tools canadian unclaimed money search: However, you can't check if you have a refund due to you until you. You will receive an amended tax credit certificate (tcc) in respect of.

If you’re using claim form, include a page confirming: Section 155 (14) provides that if any claim of tds is left at the time of filing of income tax return and assessee subsequently comes to know of any tax deducted by a. If you’re claiming over the phone, call hm revenue and customs to ask them to backdate your claim.

Retrieving an unclaimed tax refund often requires a combination of awareness, diligence, and understanding of your tax agency's. Department of veterans affairs (va) database for unclaimed insurance funds. To access the system, you need your social security number, filing status (individual, married filing jointly, married filing separately, etc.), and the exact refund.

Your refund if you claim the eitc, your refund may be delayed. In some cases, the unclaimed property you find actually belonged to someone who has passed on. If you were expecting a federal tax refund and did not receive it, check the irs where’s my refund page.

However, it may not be.