Best Info About How To Check Your Refund Status

The systems are updated once.

How to check your refund status. Available on irs.gov or the irs2go mobile app, where's my refund allows taxpayers to track their refund through three stages: As of feb. To log in, you'll need your social security number, filing status and the expected amount of your refund.

But you’ll have to wait until feb. Check your federal or state. Get your refund your way.

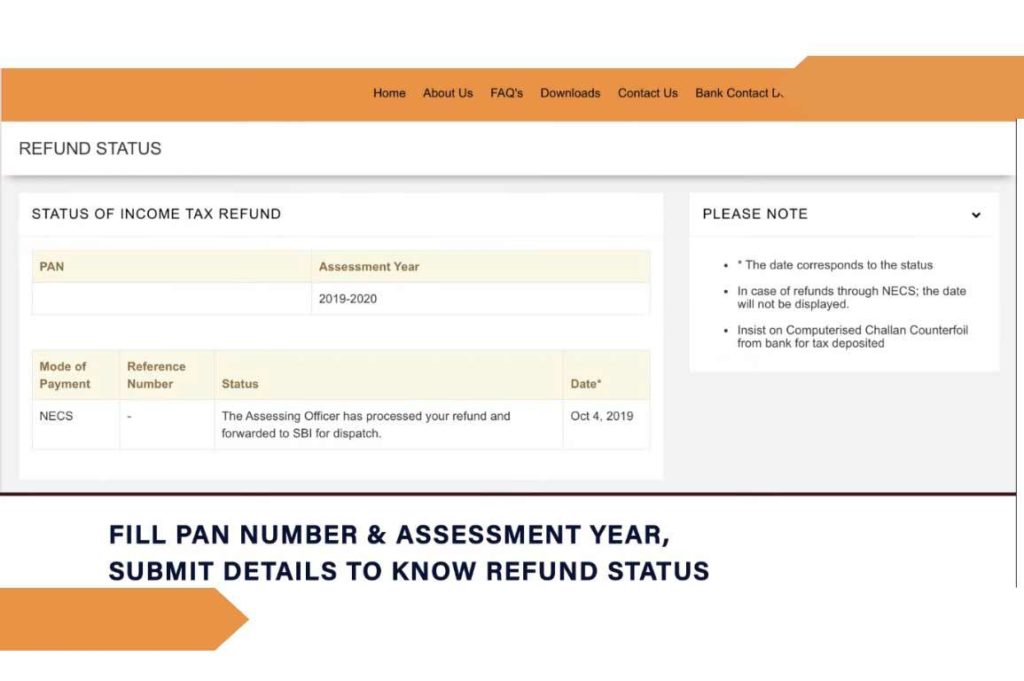

Your social security or individual taxpayer id number (itin) your filing status. Tracking the status of a tax refund is easy with the where's my refund? Status of 'paid' refund, being.

Check your refund status online—anytime, anywhere! Use the irs where's my refund tool or the irs2go mobile app to check your refund online. The irs updates the app overnight, so if you don't see a status change,.

To log in, you'll need your social security number, filing status and the expected amount of your refund. The most convenient way to check on a tax refund is by using the where's my refund? Other ways to check if your.

Low income tax clinic (litc). Tool will give you detailed status messages. Is this content promoted to.

Free tax help. Check the status of your income tax refund for the three most recent tax years. If you owe money or are receiving a refund, you can check your return status by signing in to view your irs online account information.

This is the fastest and easiest way to track your refund. What you need. Check the status of your tax refund.

To use the online tool, filers will need to have their social security number,. Taxpayers can start checking their. It's available anytime on irs.gov or through the irs2go app.

The exact refund amount on your return. Learn about unclaimed tax refunds and what to do if your refund is lower than expected. 17 to see updated projected deposit dates on the where’s my refund tool if you take those credits, the irs said.