Unique Tips About How To Check Nc State Tax Refund

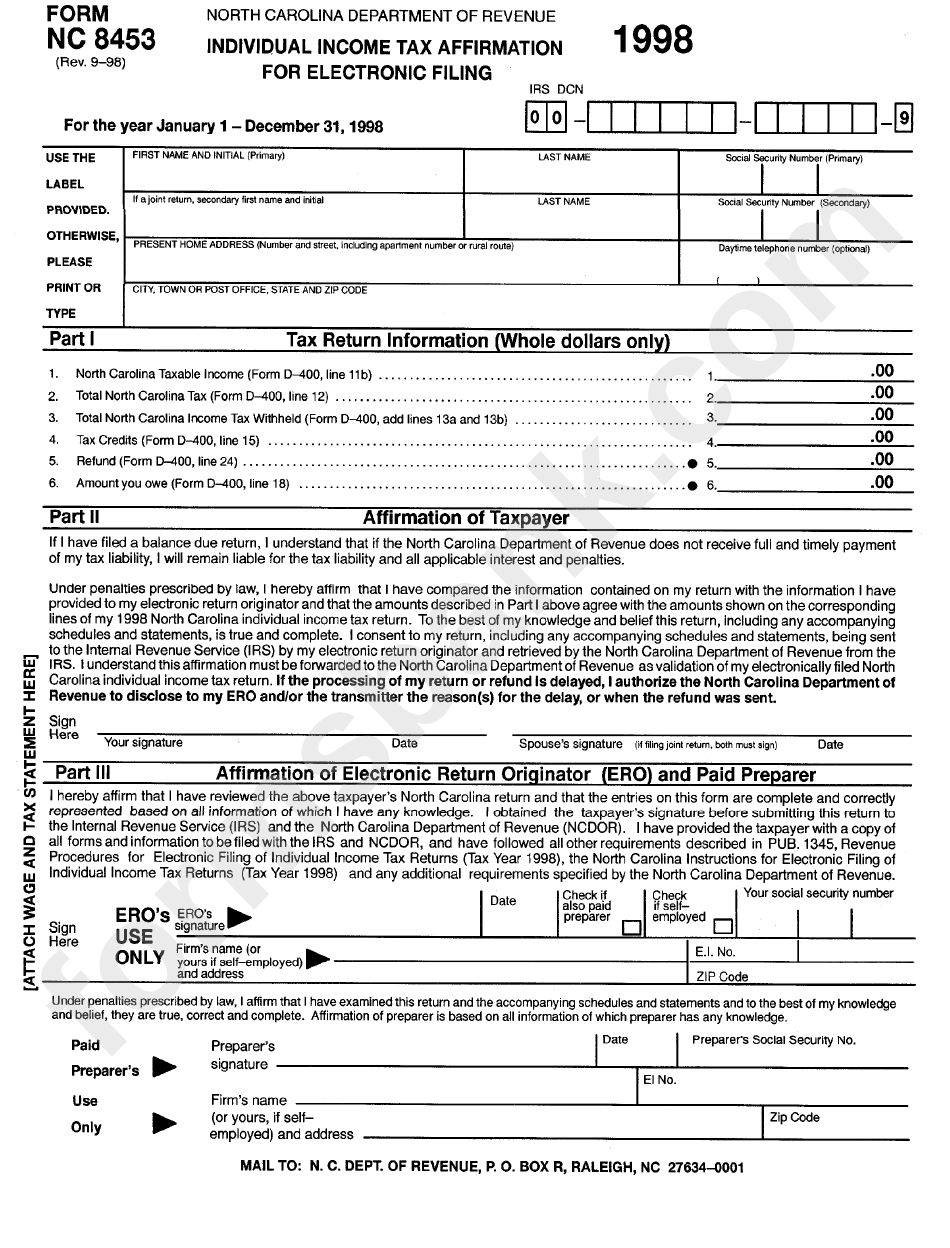

Current year tax return is.

How to check nc state tax refund. You can get up to date information regarding refund processing and check the status of your refund online at. Updated on december 14, 2023 written by derek silva, cepf® edited by jeff white when you file your federal income tax return, you can check the status of your tax refund by. Order tax forms & instructions.

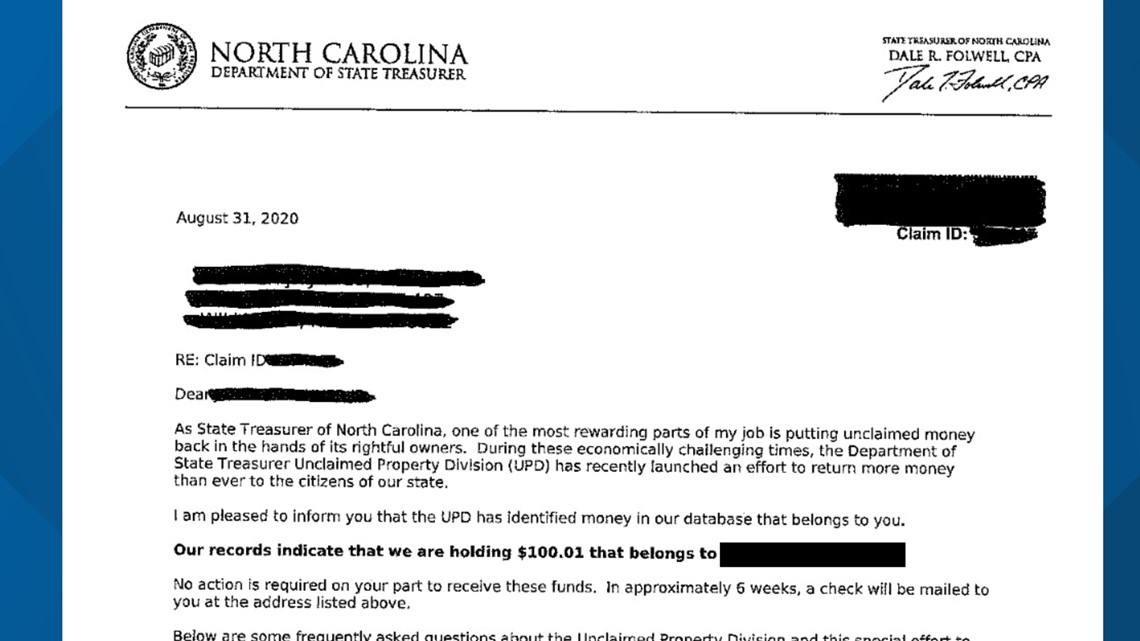

How to check the status of your nc tax refund you can use the “where’s my refund” tool on the ncdor website to check the status of your state refund. Tax season opened late due to the delayed state budget, which included tax law changes. Once we receive your return, we’ll prepare it for processing.

Check the status of your 2023 original income tax refund. If your refund check has been lost, destroyed or. If we don’t need additional information, we’ll begin processing.

Check your north carolina tax refund status using these resources. State tax forms & instructions. Lines are available 24 hours a day 7 days a week.

For the latest breaking news, weather and. You can elect to have your state refund direct deposited even if your federal return is a tax due or vice versa. North carolina offers two primary methods for filing:

Select one of the following options: To check your refund status, you will need your social security number or itin, your filing status and the exact refund amount you are expecting. Statement from the north carolina department of revenue:

Those who file online can check the status of their returns. The state didn't begin accepting returns until march 1, 2022. In order to view status information, you will be prompted to enter the social security number listed on your tax return along with the exact amount of your.

You can check the status of your refund online by using our where’s my refund? You send your nc tax return to ncdor. If you chose direct deposit, the money should land in your account within five days from the date the irs approves your refund.

Check your federal tax refund status. The maximum tax credit available per kid is $2,000 for each child under 17 on dec. It generally takes less than 21 days from the time the irs approves the amount to receive a refund.

The north carolina state department of revenue is where you can find your nc state tax refund status. Check the status of your 2023 original income tax refund. Taxpayers anticipating a refund can either expect a check in the mail or a direct deposit starting the week of march 13.